Places To Live // USA //

Buying a home in Edina, Minnesota?

%

Quality of life score

Population

Population Growth

Loading Google Maps...

Typical Weather

F

Average Temp

Sky Hours

Percent Sun

in

Annual Rain

in

Annual Snow

Earthquake

/365

Clear Days

/14,129

Heat Days

/365

Rain Days

/365

Snow Days

NeighborhoodLens for Home Buyers

From house hunting gotchas (like seller disclosure requirements, insurability and potential property damage risks) to neighborhood must-knows (like population growth and quality of life indicators) this guide can help you know what to expect to make an informed, confident home buying decision.

Real Estate Market

Home buying in

Median Year Built

Owner-Occupied

Median Property Value

Renter-Occupied

Overview

Real Estate Overview Data Needed

Why It Matters

Why It Matters Data Needed

Property Construction

Property Construction Data Needed

2010 or later

2000-2009

1990-1999

1980-1989

1970-1979

1960-1969

1950-1959

1940-1949

1939 or earlier

Property Values

Property Values Data Needed

$100k or less

$100k-200k

$200k-300k

$300k-400k

$400k-500k

$500k-750k

$750k-$1M

$1M or more

Population

Population Density & Growth in

Top Population (2023)

Family Population

Family Population %

Household Forecast

Population Density

Population Forecast

Non-Family Population

Non-Family Population %

Overview

Why It Matters

Economic Factors

Income rates in

Top Population (2023)

Population Growth Rate

Family Population

Owner-Occupied

Population Density

Population Forecast

Non-Family Population

Household Forecast

Renter-Occupied

Overview

Why It Matters

Total Household Income

Median Household Income

Average Household Income

Personal Income per Capita

Total Personal Income

Crime & Safety

Crime in

Mortality Index

/200

Rape Index

/200

Burglary Index

/200

Car Theft

/200

Murder Index

/200

Assault Index

/200

Larceny Index

/200

Total Crime

/200

Overview

Why It Matters

Buyer's Guide

Expect the unexpected

While it's nearly impossible to know everything about a home before you buy, there are ways to avoid unplanned, costly repairs after closing. It starts with knowing a property's history, assessing the current condition and evaluating future potential risks so you can negotiate, budget and buy with confidence.

Know The Property History

Knowing a property's past can help you plan and budget for future repairs and improvements

What are real estate seller disclosures?

Key

Required Disclosures

Fire Disclosure

Flood Disclosure

Pest Disclosure

Lead Paint Disclosure

Why Seller Disclosures Matter

Why Seller Disclosures Matter Data Needed

Buyer Beware

You're probably asking yourself, "Wait, aren't homeowners required to disclose issues when selling? What gives?!"

Buyer Beware Data Needed

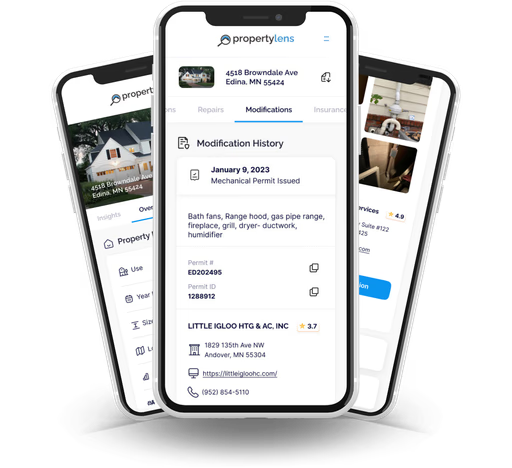

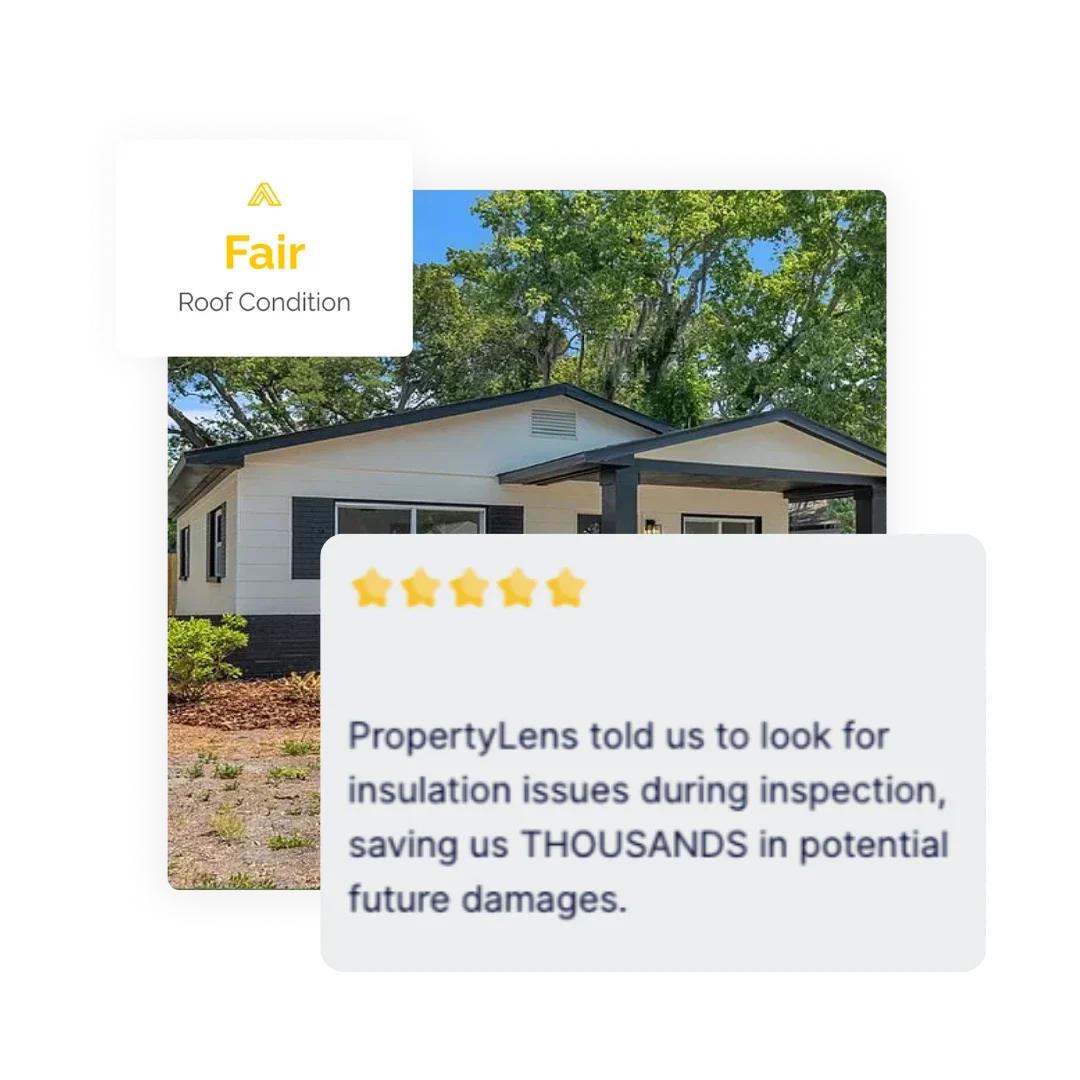

Pro Tip: Buy with Confidence

Consider running a PropertyLens report to get a detailed history of any property including prior damage, modifications and repairs, as well as, a customized BuyerLens list of findings and questions to ask the seller to fill in the knowledge gaps.

Assess Current Condition

Getting a thorough home inspection

What are home inspections?

A home inspection is a thorough evaluation of a property's condition, typically conducted by a professional home inspector. The inspection usually takes place after an offer has been accepted but before the sale is finalized. The inspector examines various aspects of the home, including the structure, electrical systems, plumbing, roofing, HVAC (heating, ventilation, and air conditioning), and more.

Why Home Inspections Matter

Why Home Inspections Matter Data Needed

Buyer Beware

After an open house, you may think, "But everything looks good. Do I really need an inspection?" The ideal answer is yes.

Buyer Beware Data Needed

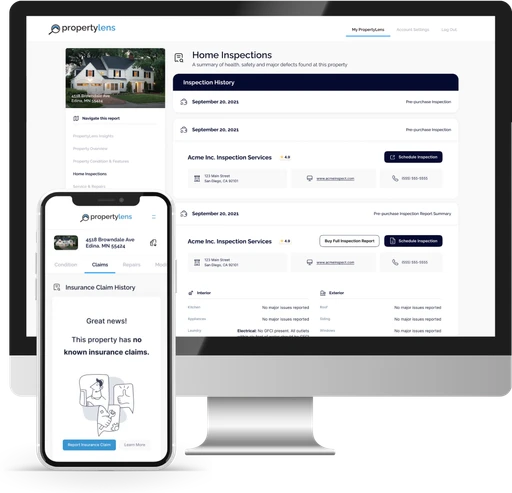

Pro Tip: Buy with Confidence

Consider running a PropertyLens report to get current and historic roof imagery as well as our customized InspectorLens checklist before scheduling a home inspection. Being able to look back at a birds eye view can help you spot unpermitted changes to the property and get a sense for roof damage over time. While home inspections are a critical part of buying a property, inspectors can overlook key issues - intentionally or not. The PropertyLens Report InspectorLens is your secret weapon for getting the most out of your home inspection.

Anticipate Future Risks

Common Risks in

Top 3 Property Damage Threats

01

02

03

What is property insurance?

Property insurance is a type of coverage that protects homeowners against financial loss from various risks associated with their property. These risks can include damage from events like fire, theft, vandalism, storms, and other natural disasters. Property insurance typically covers the physical structure of the home, personal belongings inside the home, and liability for accidents that occur on the property.

Why It Matters

- Financial Protection: Property insurance provides a safety net by covering repair or replacement costs in case of damage to the home or belongings, helping to avoid significant out-of-pocket expenses.

- Mortgage Requirement: Most mortgage lenders require property insurance as a condition for lending. This ensures that their investment is protected in case of unforeseen events.

- Peace of Mind: Knowing that your home and belongings are protected against potential risks gives you peace of mind, allowing you to focus on enjoying your new home.

- Liability Coverage: Property insurance often includes liability coverage, protecting you if someone is injured on your property and decides to sue.

- Risk Management: It helps manage the financial risks associated with owning a home, ensuring that unexpected events don't lead to financial hardship.

Buyer Beware

Pro Tip: Buy with Confidence

Consider running a PropertyLens report to get key insurability factors to know ahead of time. Each PropertyLens Report includes an InsuranceLens which gives you customized premium estimates, the property risks That May Impact Premium or Require Additional Coverage and In-Depth Premium & Replacement Cost Factors to make sure your purchase is fully protected.

Avoid buyers remorse

with PropertyLens

All too often we hear the unfortunate stories of unforeseen issues that can cost you or your family thousands after closing. Don't be one of them.

1.

Find properties

you LOVE

Whether you're just starting to house hunt or ready to make an offer, start by identifying properties you would consider buying.

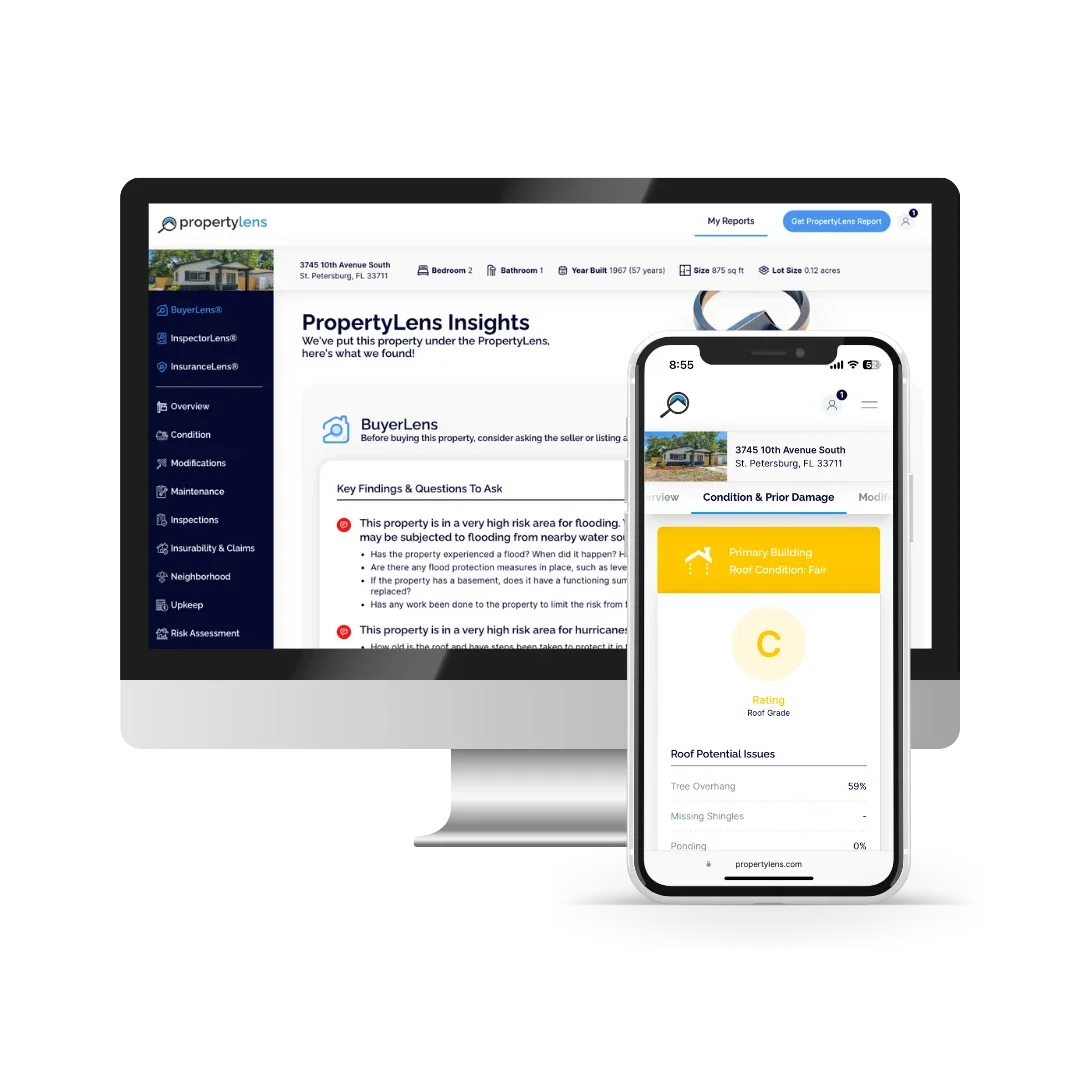

2.

Put them under the PropertyLens

In minutes, learn what sellers may be hiding and what to do about it with customized questions, inspection checklists, roof condition photos and SO MUCH MORE!

3.

Buy with

confidence!

Avoid the regretful "If only I had known before I bought it!" With PropertyLens, you can be a home buying genius!